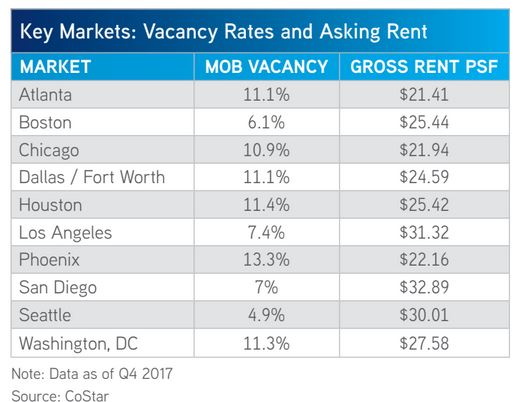

The medical office building is the most stable asset in the healthcare real estate space, as Collier’s new 2018 Healthcare Marketplace report attests. The national MOB vacancy fell for the sixth successive year in 2017 to an all-time low of 7.3%.

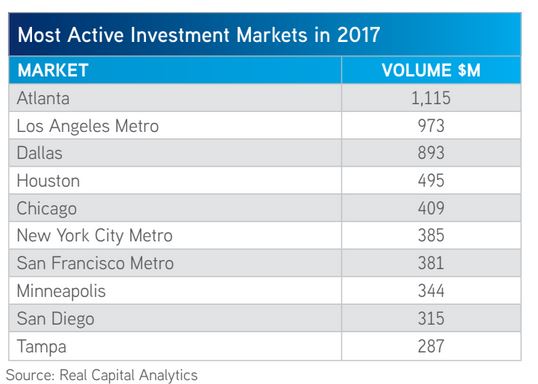

As for investment in MOBs, according to the report, that rose from $9.2 billion in 2016 to $11.3 billion in 2017, while cap rates compressed to an average of 6.4%.

“The medical office building is the most common asset that a healthcare system or provider will sell,” Mary Beth Kuzmanovich, National Director, Healthcare Services at Colliers, tells GlobeSt.com. “The healthcare tenant is pretty consistent staying in the building, renewing their lease and paying their rent.”

There are headwinds, of course, as there are in every asset class. There are the perennial issues around healthcare reimbursement including the recent weakening of the Affordable Healthcare Act, the aging baby boomer generation and that impact on increased Medicare enrollment as well as the increased use of high deductible plans by employers.

More recently, new trends have emerged that could also have an impact on medical office buildings. For example, Kuzmanovich notes that employers have been becoming more innovative in their attempts to stabilize the employer cost on healthcare.

Perhaps the most ambitious of these attempts is the decision announced earlier this year by Amazon, Warren Buffett and JPMorgan Chase to create a company to provide their employees with high-quality, affordable care. Little details have been provided and whether it will have an effect on medical office buildings is still unclear. It does seem though, based on the broad outline of the endeavor, that real estate will play some role in providing this service.

“All of these variables create an ongoing uncertainty,” Kuzmanovich says.

Other players as well are entering the health care space, intent on creating new patient care delivery models.

Realigning The Pharmacy Net Lease Sector

Last week, for instance, it was reported that Wal-Mart and insurance company Humana were having early-stage talks about strengthening their existing partnership, including a possible acquisition. There have been other proposed and completed deals that could align healthcare real estate, especially in the net least space. Cigna and Express Scripts, Optum Rx and United Healthcare, Optum’s acquisition of DaVita Medical Group last year for $4.9 billion and, of course, CVS’ acquisition of Aetna for $69 billion and Walgreen’s $4.3-billion purchase of 1,932 stores, three distribution centers and inventory from Rite Aid.

Not all of these deals have been finalized yet and there is always the specter of antitrust regulators stepping in. The American Antitrust Institute, for example, has warned the Justice Department about the CVS and Aetna merger.

The Changes That Tech Will Bring

Even so the trend is clear: disruption in the form of new healthcare models is on the horizon.

Another disruptor is technology, Kuzmanovich says. “I think technology continues to be a game changer across the industry. The advent of portable devices and wearable tech is making seeing a doctor more accessible.” It will be interesting to watch, she says, how the mainstreaming of telemedicine or the ability to Skype with a nurse or doctor or the ease of downloading medical information from a Fitbit or other device will affect the medical office building. “That technology is compounding to potentially reduce the demand for medical offices in the long run.”

On the other hand there is the example of Mercy Hospital in St. Louis, which has set up a telemedicine hub to provide primary care and other services, Kuzmanovich continues. “There will be demand in the healthcare space to support these emerging technologies, creating a new opportunity within the sector.”

Source: GlobeSt.

Florida’s controversial “pregnancy support centers” will receive permanent state funding under a bill signed into law this week by Gov. Rick Scott.

The new law provides funding for the often faith-based organizations that offer emotional support and limited medical services for unplanned pregnancies — while also working to prevent abortions — through the Florida Department of Health.

The centers are part of the Florida Pregnancy Care Network, which has received more than $21 million in state funding since 2007, according to the health department, including $4 million in the current fiscal year.

With services that range from testing for sexually transmitted diseases to parental counseling, they are largely unregulated and their operations can vary significantly depending on the location. Some employ nurse practitioners or physicians. Others rely on church volunteers to take ultrasound images, provide medical information with sometimes questionable accuracy and deliver an anti-abortion message.

In previous years, the network would receive funding on an annual contractual basis. Now funding with the health department will be permanent. Health care providers like Planned Parenthood, which offer abortion services, say the pregnancy support centers “use medically inaccurate information to oppose abortion and judge, shame, and mislead women.”

“By signing this bill, Gov. Scott is demonstrating a total disregard for the truth, undermining a woman’s right to make her own informed medical decisions and denying her the respect and dignity she deserves,” said Laura Goodhue, executive director of the Florida Alliance of Planned Parenthood Affiliates in a statement.

The lawmakers who sponsored the bills — Sen. Aaron Bean, R-Fernandina Beach, and state Rep. Jackie Toledo, R-Tampa — said the legislation gives pregnant women more choices during a vulnerable in their lives.

The Florida law comes as the U.S. Supreme Court is considering arguments over a California law requiring pregnancy crisis centers to provide information about contraception and abortion. The decision could impact laws in other states, including Florida.

Source: Tampa Bay Times

In Florida, a long-running healthcare industry legal battle could be coming to an end, thanks to the rare feat of passing bipartisan legislation affecting trauma centers.

The legislature this week passed a bill that will change how trauma centers are distributed throughout the state. It will also designate some HCA facilities as trauma centers, thus ending several legal challenges. And it will establish an advisory council that can help resolve future conflicts.

What exactly is a trauma center?

“Emergency rooms are not trauma centers,” according to the Florida Committee on Trauma. Whereas any emergency room has staff who can treat a broken bone or mild burn, a facility that is designated as a trauma center “has highly trained specialists in-house or immediately available 24 hours a day, 7 days a week.”

Trauma centers must meet certain state standards and are specially prepared to handle things like major car accidents, severe burns and gunshot wounds. A trauma center can be part of a hospital or in some cases, a stand-alone facility.

Like it or not, healthcare in America is a business, and hospitals must compete for patients, their paying customers. Because hospitals are expensive to run, the state wants enough of them to serve the population, but no so many that patients are spread thin and rates increase. Like about 30 other states, Florida regulates how many hospitals can open, and where. The state regulates trauma centers in similar fashion.

There are 303 hospitals in Florida, 209 of them with emergency departments, according to the Florida Hospital Association. Yet the state has only 27 trauma centers.

Under current regulations, which have been in place for 26 years, a hospital can receive a designation as a Level I, Level II, pediatric or provisional trauma center depending on its offerings. Florida’s 67 counties are divided into 19 “trauma service areas” and only a certain number of trauma centers are allowed in each.

In recent years, for-profit HCA Healthcare pushed to open trauma centers at more of its hospitals. Competitors balked, filing legal challenges that have wound through the courts for a decade.

Some have argued the market should be opened and hospitals should be allowed to open more trauma centers in crowded or lucrative areas. Others have argued that such a move would siphon patients from needier areas and disadvantage rural and community hospitals.

Legislators this year, after exhaustive meetings with hospital industry leaders, said they have finally worked out a compromise. New rules would dictate that no service area can have more than five trauma centers, nor more than one stand-alone pediatric trauma center. The service area borders would be adjusted and the number of areas would drop from 19 to 18. The Department of Health would establish an 11-member Florida Trauma System Advisory Council, which would begin meeting in 2019.

The new rules would also settle the litigation by approving three HCA trauma centers: at Kendall Regional Medical Center, Orange Park Medical Center and Aventura Hospital & Medical Center. One HCA facility, Northside Hospital in St. Petersburg, would not be allowed to proceed with trauma center designation.

The bill passed the state House and Senate unanimously and will go to Gov. Rick Scott for his signature.

Income from red-light camera violations has helped fund trauma centers in Florida to the tune of $12.6M in 2012. Following a mass shooting incident at Marjory Stoneman Douglas High School in Parkland Feb. 14, state lawmakers have been considering measures that would take money collected from applications for firearm licenses and direct those funds to trauma centers as well.

Source: Bisnow