While there has been a surge in construction of new healthcare facilities over the last few years, many providers are looking at renovations instead.

“Every dollar has to count,” said HKS Architects principal and Pediatric Practice Leader Rachel Knox, who was one of the panelists at Bisnow’s State of Denver Healthcare event Oct. 4 at the Hyatt Regency Aurora-Denver Conference Center. “There’s been an emphasis on renovation projects in what used to be subpar space. Now, it’s ‘how can we create parity between new and old and make it seem seamless for the patients and staff to use that space?’”

Phoenix-based Banner Health, which serves northern Colorado, has a new hospital in Fort Collins, but Senior Project Executive of Development and Construction Kyle Majchrowski said the healthcare provider explores both repurposing an existing building and new construction when determining how to expand its presence.

“Repurposing has moved up,” Majchrowski said. “We ask, ‘Do we really need all that space, or can we change or modify it?’ We have a lot of unused real estate — let’s take advantage of it and see what we can do with it.”

WSP Senior Vice President Mark Montgomery said renovating a property provides flexibility and adaptability, but if the square footage isn’t adequate, the building must either be razed and rebuilt or sold.

Of the eight free-standing emergency departments Fleisher Smyth Brokaw CEO Michelle Brokaw has developed over the last three years, three were renovations. But, she said, they all cost the same to develop — the location is the key.

“Now everything has to be on the corner of Main and Main,” Brokaw said. “We spend a lot of time building out old bank buildings.”

Event panelists also discussed the labor shortage, building strong development teams, how to maintain access to healthcare to the region’s most vulnerable people and how to implement technology into medicine.

“Every major company, whether it’s Google or Apple, is thinking about what technology should be deployed in healthcare right now,” University of Colorado Managing Director of Innovations on the Anschutz Medical Campus Kimberly Muller said. “Every segment of our economy has been transformed by technology. Healthcare and education are the last two industries to be disrupted by technology.”

Technology will allow patients to be cared for in their homes rather than hospitals, but the reimbursement model has to change to allow that to happen, Children’s Hospital Colorado CEO Jena Hausmann said. Today, many children are admitted to a hospital after an emergency room visit so staff can monitor their oxygen levels. Children’s has spent $30M over the last 10 years figuring out how to get parents to perform that task.

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

Phoenix-based Banner Health, which serves northern Colorado, has a new hospital in Fort Collins, but Senior Project Executive of Development and Construction Kyle Majchrowski said the healthcare provider explores both repurposing an existing building and new construction when determining how to expand its presence.

“Repurposing has moved up,” Majchrowski said. “We ask, ‘Do we really need all that space, or can we change or modify it?’ We have a lot of unused real estate — let’s take advantage of it and see what we can do with it.”

WSP Senior Vice President Mark Montgomery said renovating a property provides flexibility and adaptability, but if the square footage isn’t adequate, the building must either be razed and rebuilt or sold.

Of the eight free-standing emergency departments Fleisher Smyth Brokaw CEO Michelle Brokaw has developed over the last three years, three were renovations. But, she said, they all cost the same to develop — the location is the key.

“Now everything has to be on the corner of Main and Main,” Brokaw said. “We spend a lot of time building out old bank buildings.”

Event panelists also discussed the labor shortage, building strong development teams, how to maintain access to healthcare to the region’s most vulnerable people and how to implement technology into medicine.

“Every major company, whether it’s Google or Apple, is thinking about what technology should be deployed in healthcare right now,” University of Colorado Managing Director of Innovations on the Anschutz Medical Campus Kimberly Muller said. “Every segment of our economy has been transformed by technology. Healthcare and education are the last two industries to be disrupted by technology.”

Technology will allow patients to be cared for in their homes rather than hospitals, but the reimbursement model has to change to allow that to happen, Children’s Hospital Colorado CEO Jena Hausmann said. Today, many children are admitted to a hospital after an emergency room visit so staff can monitor their oxygen levels. Children’s has spent $30M over the last 10 years figuring out how to get parents to perform that task.

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

WSP Senior Vice President Mark Montgomery said renovating a property provides flexibility and adaptability, but if the square footage isn’t adequate, the building must either be razed and rebuilt or sold.

Of the eight free-standing emergency departments Fleisher Smyth Brokaw CEO Michelle Brokaw has developed over the last three years, three were renovations. But, she said, they all cost the same to develop — the location is the key.

“Now everything has to be on the corner of Main and Main,” Brokaw said. “We spend a lot of time building out old bank buildings.”

Event panelists also discussed the labor shortage, building strong development teams, how to maintain access to healthcare to the region’s most vulnerable people and how to implement technology into medicine.

“Every major company, whether it’s Google or Apple, is thinking about what technology should be deployed in healthcare right now,” University of Colorado Managing Director of Innovations on the Anschutz Medical Campus Kimberly Muller said. “Every segment of our economy has been transformed by technology. Healthcare and education are the last two industries to be disrupted by technology.”

Technology will allow patients to be cared for in their homes rather than hospitals, but the reimbursement model has to change to allow that to happen, Children’s Hospital Colorado CEO Jena Hausmann said. Today, many children are admitted to a hospital after an emergency room visit so staff can monitor their oxygen levels. Children’s has spent $30M over the last 10 years figuring out how to get parents to perform that task.

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

“Now everything has to be on the corner of Main and Main,” Brokaw said. “We spend a lot of time building out old bank buildings.”

Event panelists also discussed the labor shortage, building strong development teams, how to maintain access to healthcare to the region’s most vulnerable people and how to implement technology into medicine.

“Every major company, whether it’s Google or Apple, is thinking about what technology should be deployed in healthcare right now,” University of Colorado Managing Director of Innovations on the Anschutz Medical Campus Kimberly Muller said. “Every segment of our economy has been transformed by technology. Healthcare and education are the last two industries to be disrupted by technology.”

Technology will allow patients to be cared for in their homes rather than hospitals, but the reimbursement model has to change to allow that to happen, Children’s Hospital Colorado CEO Jena Hausmann said. Today, many children are admitted to a hospital after an emergency room visit so staff can monitor their oxygen levels. Children’s has spent $30M over the last 10 years figuring out how to get parents to perform that task.

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

“Every major company, whether it’s Google or Apple, is thinking about what technology should be deployed in healthcare right now,” University of Colorado Managing Director of Innovations on the Anschutz Medical Campus Kimberly Muller said. “Every segment of our economy has been transformed by technology. Healthcare and education are the last two industries to be disrupted by technology.”

Technology will allow patients to be cared for in their homes rather than hospitals, but the reimbursement model has to change to allow that to happen, Children’s Hospital Colorado CEO Jena Hausmann said. Today, many children are admitted to a hospital after an emergency room visit so staff can monitor their oxygen levels. Children’s has spent $30M over the last 10 years figuring out how to get parents to perform that task.

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

“There is always a push to outpatient treatment or discharging patients sooner,” Hausmann said. “But just because we save somebody money in the system, doesn’t mean it gets to the consumer or governmental payers.”

Source: Bisnow

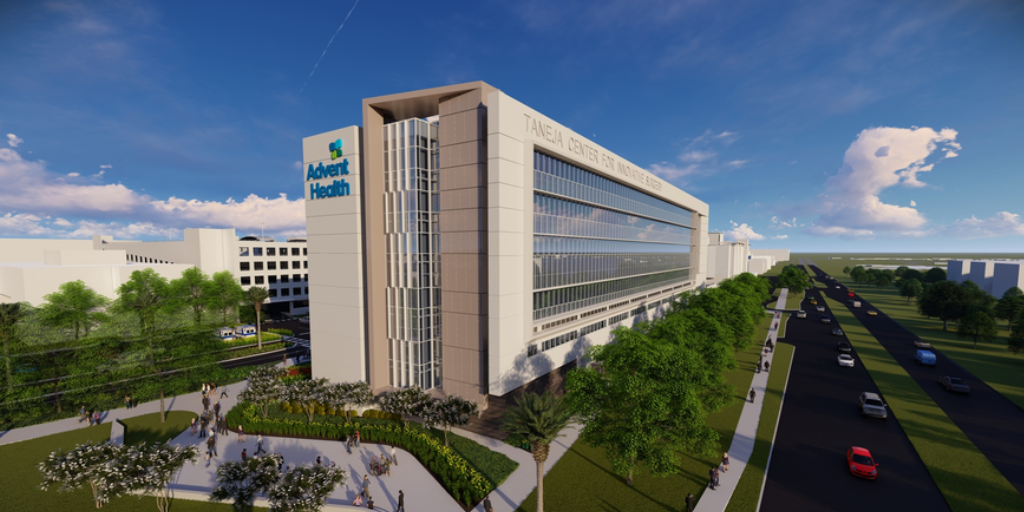

Florida Hospital Tampa, part of Adventist Health System, has broken ground on a six-story, 300,000-square-foot patient and surgical tower at the corner of Fletcher Avenue and Bruce B. Downs Boulevard in Tampa.

The $256 million expansion project will be known as the Taneja Center for Innovative Surgery and is slated to open in 2021. According to a press release, it will feature 24 new operating rooms, a new hospital entrance and more than 100 private dedicated surgical care beds. It will create an estimated 117 clinical jobs in its first year of operation, and 587 jobs by the fifth year, the release states.

“This is a state-of-the-art project that will provide specialty care in Tampa Bay that you can’t find anywhere else in our area,” states Brian Adams, president and CEO of Florida Hospital Tampa, in the release. “Our goal is to design a surgical tower that isn’t just relevant today, but will be relevant 30 years from now, combining surgical innovation and the most advanced robotic technologies with the nation’s best physicians.”

The family of Jugal and Manju Taneja provided a generous gift toward the expansion project — the largest donation ever to the hospital’s west Florida division.

“This is about more than growth and expansion,” states Mike Schultz, president and CEO of Florida Hospital West Florida Division, in the release. “This is about connecting our community to the kind of expert health care that’s needed and delivering it with Florida Hospital’s unique brand of inspired, compassionate care.”

Source: Business Observer

“This is a state-of-the-art project that will provide specialty care in Tampa Bay that you can’t find anywhere else in our area,” states Brian Adams, president and CEO of Florida Hospital Tampa, in the release. “Our goal is to design a surgical tower that isn’t just relevant today, but will be relevant 30 years from now, combining surgical innovation and the most advanced robotic technologies with the nation’s best physicians.”

The family of Jugal and Manju Taneja provided a generous gift toward the expansion project — the largest donation ever to the hospital’s west Florida division.

“This is about more than growth and expansion,” states Mike Schultz, president and CEO of Florida Hospital West Florida Division, in the release. “This is about connecting our community to the kind of expert health care that’s needed and delivering it with Florida Hospital’s unique brand of inspired, compassionate care.”

Source: Business Observer

“This is about more than growth and expansion,” states Mike Schultz, president and CEO of Florida Hospital West Florida Division, in the release. “This is about connecting our community to the kind of expert health care that’s needed and delivering it with Florida Hospital’s unique brand of inspired, compassionate care.”

Source: Business Observer

The Sarasota Memorial Health Care System plans to spend $17.3 million to buy and renovate the former Sarasota Herald-Tribune building on Main Street and move more than 300 support services personnel to the three-story downtown site.

The hospital’s board unanimously approved the plan Monday.

Relocating the employees would free space for growth on the hospital’s main campus and improve “interdepartmental efficiencies” among support service departments scattered in different buildings, hospital staff stated in the proposal.

The hospital’s plan includes building a one-story parking structure that would add 90 to 100 spaces to the current 240 ground-level parking spots.

“We’re landlocked now on the main campus,” said hospital board member Tramm Hudson. “This frees up space inside the campus for clinical expansion and patient care. This is a good value for the citizens of Sarasota County and for health care.”

The hospital said it would spend $11.8 million to acquire the property and $2.26 million to build the parking garage. Other costs would raise the project price tag to $17.33 million.

With the 8-0 vote for the plan, due diligence on the purchase will begin immediately and conclude by Nov. 20, according to the hospital staff’s timeline. Closing of the purchase would occur by Jan. 20, and renovations would begin the following week, with completion by April and full occupancy on May 27.

Local developer Wayne Ruben signed a contract in June to buy the building, most recently listed for $13.95 million, with plans to redevelop the property into a mixed-use project.

The 72,408-square-foot building sits on 3.8 acres at 1741 Main St. Built in 2006, it was first listed for sale at $18.1 million when it was fully leased to the Herald-Tribune and IberiaBank. The Herald-Tribune moved to the SunTrust building next door in February 2017, and the building is now vacant except for a portion of the third floor occupied by SNN News Now.

It is owned by an affiliate of Halifax Media Holdings of Little Rock, Arkansas, which sold the newspaper to New Media Investment Group and Gatehouse Media in early 2015.

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

Relocating the employees would free space for growth on the hospital’s main campus and improve “interdepartmental efficiencies” among support service departments scattered in different buildings, hospital staff stated in the proposal.

The hospital’s plan includes building a one-story parking structure that would add 90 to 100 spaces to the current 240 ground-level parking spots.

“We’re landlocked now on the main campus,” said hospital board member Tramm Hudson. “This frees up space inside the campus for clinical expansion and patient care. This is a good value for the citizens of Sarasota County and for health care.”

The hospital said it would spend $11.8 million to acquire the property and $2.26 million to build the parking garage. Other costs would raise the project price tag to $17.33 million.

With the 8-0 vote for the plan, due diligence on the purchase will begin immediately and conclude by Nov. 20, according to the hospital staff’s timeline. Closing of the purchase would occur by Jan. 20, and renovations would begin the following week, with completion by April and full occupancy on May 27.

Local developer Wayne Ruben signed a contract in June to buy the building, most recently listed for $13.95 million, with plans to redevelop the property into a mixed-use project.

The 72,408-square-foot building sits on 3.8 acres at 1741 Main St. Built in 2006, it was first listed for sale at $18.1 million when it was fully leased to the Herald-Tribune and IberiaBank. The Herald-Tribune moved to the SunTrust building next door in February 2017, and the building is now vacant except for a portion of the third floor occupied by SNN News Now.

It is owned by an affiliate of Halifax Media Holdings of Little Rock, Arkansas, which sold the newspaper to New Media Investment Group and Gatehouse Media in early 2015.

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

“We’re landlocked now on the main campus,” said hospital board member Tramm Hudson. “This frees up space inside the campus for clinical expansion and patient care. This is a good value for the citizens of Sarasota County and for health care.”

The hospital said it would spend $11.8 million to acquire the property and $2.26 million to build the parking garage. Other costs would raise the project price tag to $17.33 million.

With the 8-0 vote for the plan, due diligence on the purchase will begin immediately and conclude by Nov. 20, according to the hospital staff’s timeline. Closing of the purchase would occur by Jan. 20, and renovations would begin the following week, with completion by April and full occupancy on May 27.

Local developer Wayne Ruben signed a contract in June to buy the building, most recently listed for $13.95 million, with plans to redevelop the property into a mixed-use project.

The 72,408-square-foot building sits on 3.8 acres at 1741 Main St. Built in 2006, it was first listed for sale at $18.1 million when it was fully leased to the Herald-Tribune and IberiaBank. The Herald-Tribune moved to the SunTrust building next door in February 2017, and the building is now vacant except for a portion of the third floor occupied by SNN News Now.

It is owned by an affiliate of Halifax Media Holdings of Little Rock, Arkansas, which sold the newspaper to New Media Investment Group and Gatehouse Media in early 2015.

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

With the 8-0 vote for the plan, due diligence on the purchase will begin immediately and conclude by Nov. 20, according to the hospital staff’s timeline. Closing of the purchase would occur by Jan. 20, and renovations would begin the following week, with completion by April and full occupancy on May 27.

Local developer Wayne Ruben signed a contract in June to buy the building, most recently listed for $13.95 million, with plans to redevelop the property into a mixed-use project.

The 72,408-square-foot building sits on 3.8 acres at 1741 Main St. Built in 2006, it was first listed for sale at $18.1 million when it was fully leased to the Herald-Tribune and IberiaBank. The Herald-Tribune moved to the SunTrust building next door in February 2017, and the building is now vacant except for a portion of the third floor occupied by SNN News Now.

It is owned by an affiliate of Halifax Media Holdings of Little Rock, Arkansas, which sold the newspaper to New Media Investment Group and Gatehouse Media in early 2015.

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

The 72,408-square-foot building sits on 3.8 acres at 1741 Main St. Built in 2006, it was first listed for sale at $18.1 million when it was fully leased to the Herald-Tribune and IberiaBank. The Herald-Tribune moved to the SunTrust building next door in February 2017, and the building is now vacant except for a portion of the third floor occupied by SNN News Now.

It is owned by an affiliate of Halifax Media Holdings of Little Rock, Arkansas, which sold the newspaper to New Media Investment Group and Gatehouse Media in early 2015.

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

The building sits 1.7 miles from Sarasota Memorial’s campus. The hospital previously rented space for administrative staff at Sarasota Main Plaza but later moved them to space at or near the campus.

The Sarasota Memorial Health Care System, an 829-bed regional medical center, is among the largest public health systems in Florida. It has more than 5,000 staff and 900 physicians.

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

Its growth has created space challenges. For example, the perioperative suite and cardiology department are hampered by their current space and lack of room to expand, hospital staff said in its recommendation.

Under the plan, Sarasota Memorial plans to consolidate administrative functions currently at four locations. Supply chain management, corporate compliance, First Physicians Group central business office and clinical business systems would move from the main campus. The “revenue cycle” operation, which includes patient financial services and registration, would move from Hillview Street. The corporate finance department will relocate from Bee Ridge Road, and the physician IT services will come from Doctor’s Gardens.

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune

The emptied spaces would be used for expansion or other offices.

Source: Herald-Tribune